The British Columbia Business Corporations Act will soon require privately held British Columbia companies to establish and maintain a “Transparency Register” of “Significant Individuals”. This blog discusses some frequently asked questions about Transparency Registers.

1. What is the Transparency Register?

The Transparency Register is a register that identifies “Significant Individuals” of British Columbia private companies. An individual can be a Significant Individual by having:

- An interest or right, or a combination of them in 25% or more of the:

- issued shares of the company or

- voting shares of the company; or

- The right or ability, or combination of them, to elect, appoint or remove a majority of the directors of the company.

2. What information is required on a Transparency Register?

The following information is required for the Transparency Register:

- Name, birthdate, last known address of the Significant Individual;

- Citizenship information of the Significant Individual;

- Whether the Significant Individual is a tax resident of Canada;

- Date the individual became a Significant Individual;

- Date the individual ceased to be a Significant Individual; and

- What makes the individual a Significant Individual.

3. When are companies required to have a Transparency Register?

The deadline to establish a Transparency Register for British Columbia private companies is October 1, 2020.

4. What are the consequences of not having a Transparency Register?

The Penalties for not having a Transparency Register can be up to $50,000.00 for individuals (shareholders, directors, officers) and up to $100,000.00 for companies.

5. Are any legal entities excluded from the Transparency Register requirements?

The following legal entities are exempted from the Transparency Register requirements:

- Legal entities not governed by the British Columbia Business Corporations Act, British Columbia Societies and Cooperatives, as well as extra provincial companies registered in British Columbia but incorporated outside British Columbia;

- Publicly traded companies;

- Companies that are a wholly owned subsidiaries of a public corporation; and

- Other exclusions exist.

6. Who can view the Transparency Register?

The Transparency Register is not a public document. However, the following may review a corporation’s Transparency Register:

- Current directors of the company;

- Provincial police forces in British Columbia;

- The RCMP;

- The Ministry of Finance of British Columbia;

- The Canada Revenue Agency;

- The British Columbia Securities Commission;

- The British Columbia Financial Services Authority;

- The Financial Transactions and Reports Analysis Centre of Canada; and

- The Law Society of British Columbia.

7. How should Indirect Shareholdings be reported on the Transparency Register (for example, shares owned through a corporation or a trust?)

Corporations:

An individual must be listed as a Significant Individual if the individual indirectly controls:

- An intermediate legal entity that holds 25% or more of the shares or votes of a British

Columbia private company; or - An intermediate legal entity that has the right to elect or appoint a majority of the

directors of a British Columbia private company.

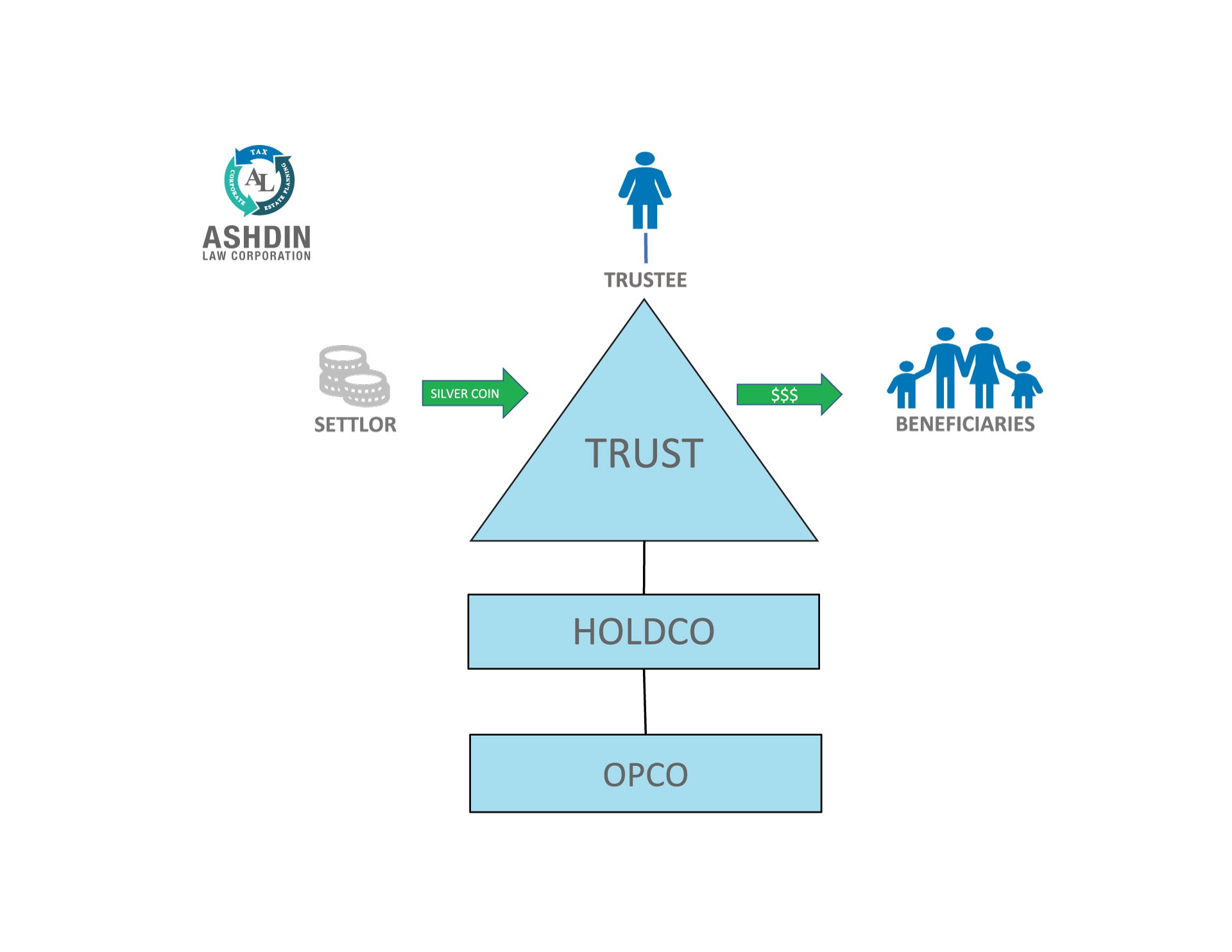

Trusts:

A trustee of a trust is the legal owner of the shares of a company but holds them for the benefit of the beneficiaries of the trust. In this situation, the trustee of the trust must be listed in the Transparency Register as well as the beneficiaries of the trust. Please refer to Part 3 of our Estate Planning blog for more information about Trusts.

If you would like to learn more about Transparency Registers, connect with Ish Lila or Shelly Lila at Ashdin Law – Corporate and Tax Lawyers, located in Coquitlam, B.C.

The above provides a practical overview about Transparency Registers. This blog is for informational purposes only. Readers are cautioned this blog does not constitute legal or professional advice and should not be relied on as such. Rather, readers should obtain specific legal advice in relation to the issues they are facing.