In part one of our estate planning blog, we discussed that trusts are an effective legal tool that also provide tax planning benefits. In part two we discussed how a joint spousal trust is one way to plan for probate. In this blog we will discuss family trusts, alter ego trusts, joint spousal trusts and disability trusts.

The non-tax benefits of using a Trust as a part of your estate plan

There are many non tax related benefits of using a trust. These benefits include:

- Reduction or elimination of Probate Fees

- Lower the probability of the validity of your Will being challenged in court

- Continuity of asset management

- Privacy and confidentiality

- Reduce the ability of a creditor to make claims against your estate’s assets

Family Trusts

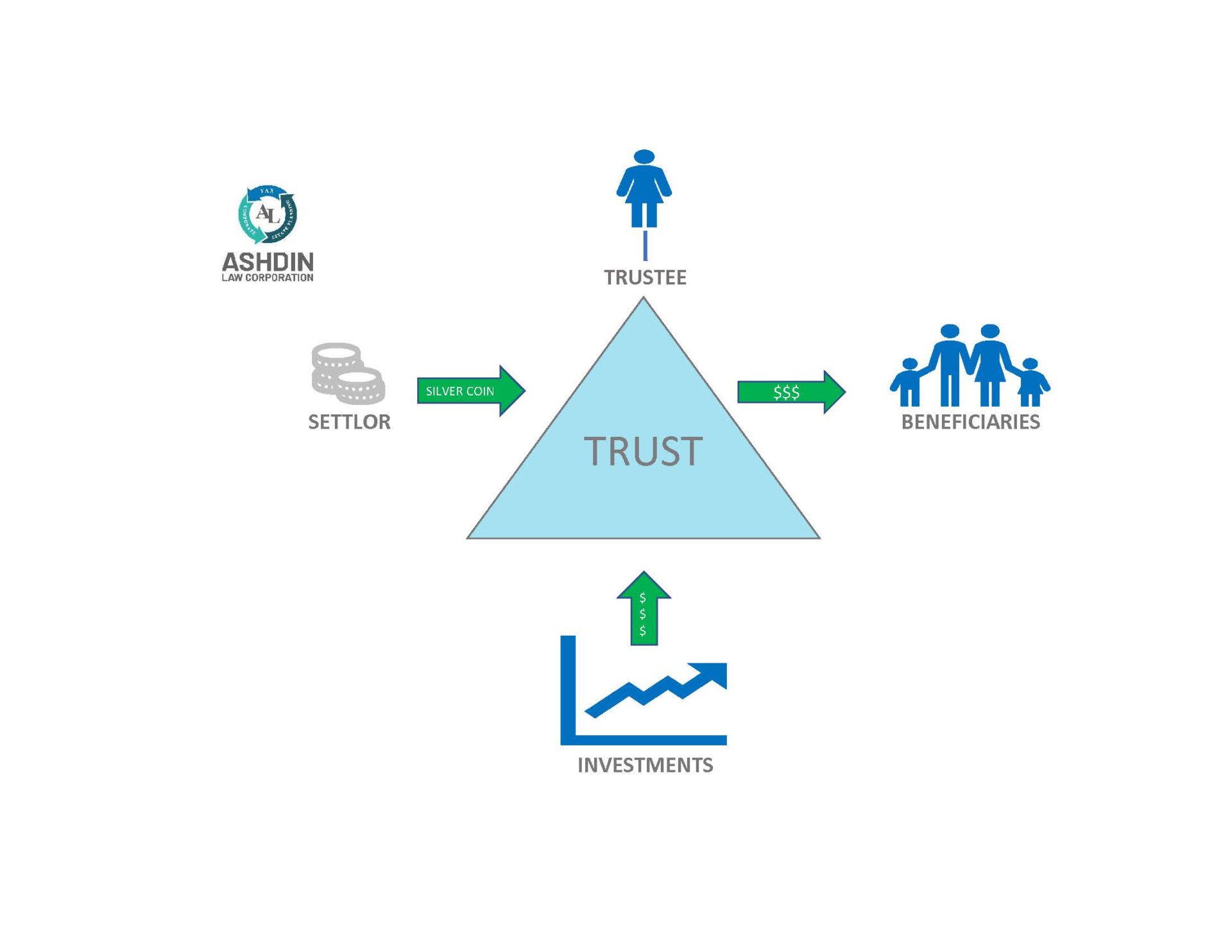

In part two of our estate planning blog, we discussed that family trusts are commonly used as a part of an estate freeze. A family trust is often used to subscribe for new common shares of a company at a nominal value. If these shares continue to grow in value over time, the tax on the growth of these shares can be pushed back for a period of up to 21 years as long as the assets remain in the trust.

Another benefit of a family trust is that capital gains and dividends may be flowed through to beneficiaries of the trust at the discretion of the trustee. Equally as important, individual beneficiaries can also make use of their lifetime capital gains exemption when the shares of a qualified small business corporation are sold. The current capital gains exemption is worth approximately $850,000 which translates in to approximately $212,500 in tax savings per individual beneficiary. Significant tax changes were made in 2017 that affect the payment of dividends by small business corporations. Therefore, these tax rules must be carefully considered when distributing dividends to beneficiaries of a trust.

Alter Ego and Joint Spousal Trusts

Another common tax planning tool for Canadian residents over the age of 65 are Alter Ego Trusts (“AET’s) and Joint Spousal Trusts (“JST’s). The Income Tax Act requires AET’s and JST’s to have specific features which must be drafted carefully in the trust indenture. An AET is a trust created by and for the benefit of a single individual and a JST is created by and for the benefit of a couple. All, or substantially all, of an individual’s property will be transferred to the AET or JST upon its creation. The trust then manages the individual’s property in accordance with the instructions contained in the trust indenture. If real estate is being transferred to an AET or JST, property transfer tax must be considered. Although property is legally transferred to the trust, the individuals continue to report the income personally on their tax returns.

After the individual has died, or in the case of a couple after both partners have died, the individual’s property is distributed in accordance with the instructions in the trust document in very much the same manner as instructions in a person’s Will. It is important to note that AET’s and JPT’s are not subject to the 21-year rule discussed above.

Disability Trusts

If a family member has a disability, a trust can be a helpful planning tool for them if it is structured and administered properly so that they are able to maintain their government benefits and entitlement. A disability trust can provide monthly income for beneficiaries while protecting the capital.

If you would like to learn more about the use of trusts for estate planning purposes, connect with Ish Lila or Shelly Lila at Ashdin Law – Corporate and Tax Lawyers, located in Coquitlam, B.C.

The above provides a practical overview about the use of trusts in estate planning. This blog is for informational purposes only. Readers are cautioned this blog does not constitute legal or professional advice and should not be relied on as such. Rather, readers should obtain specific legal advice in relation to the issues they are facing.